Real Estate ESG Management Solution for Family Offices

Nobody should have to experience problems with real estate ESG management.

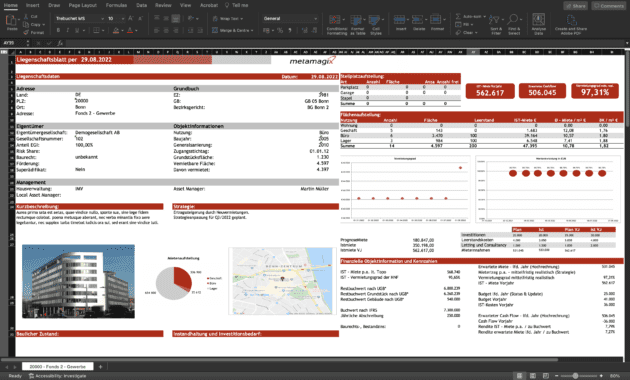

| Area: | 5.700 m2 |

| Market Value: | 13,3 Mio € |

| Occupancy rate: | 97% |

| Yield (VW): | 9.2% |

| Area: | 3.200 m2 |

| Market Value: | 8,3 Mio € |

| Occupancy rate: | 93% |

| Yield (VW): | 5,1% |

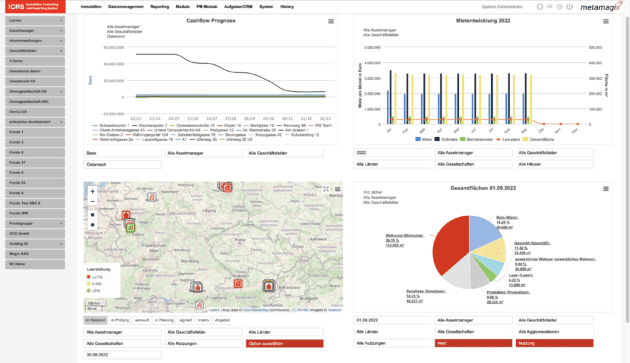

Successful Real Estate Assets & Portfolio Management with ICRS

Relevant Rating for Your Properties

The rating can be adjusted and improved at any time by adding investments or other items (e.g. certifications, improvements in terms of waste management or energy efficiency, bicycle parking, etc.).

Reports for Your Team & Clients

Reporting to your stakeholders has never been easier. With ICRS, you can automate the regular reports and keep your stakeholders updated.

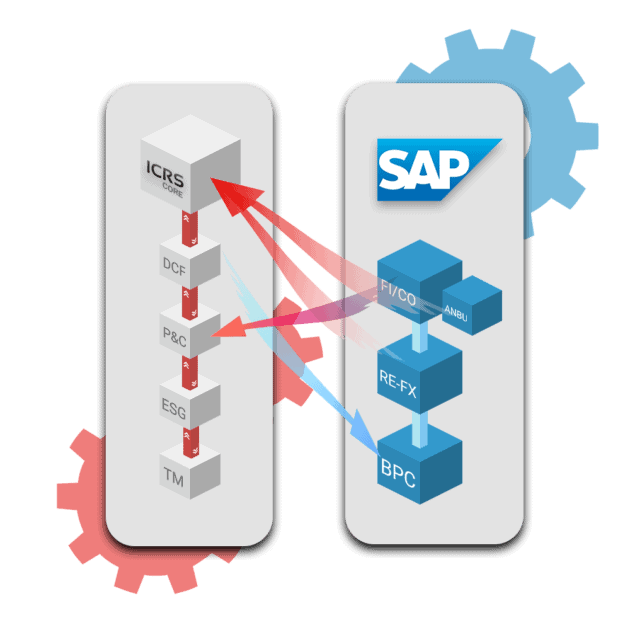

The Perfect Complement to SAP

Seamlessly integrated with SAP, ICRS provides you with exactly those features for real estate investors in asset management and portfolio control that SAP does not offer.

Reduce the Workload

Imagine how your daily business would look like with such a powerful tool. Save time and reduce errors with automatic data imports.

-

metamagix.ICRS Core System

The out-of-the-box software solution with all the necessary features for successful asset and portfolio…

Info -

Scoring & Rating

Evaluate objects with a free definition of scoring models.…

Info -

Market Data

Integrates market data into the ICRS database and allows linking to them in individual…

Info -

Portfolio Explorer

State-of-the-art ad-hoc reporting for all data, directly in the browser of your ICRS system.…

Info

Plan Your Solution Today!

Don’t struggle alone – make progress faster with assistance