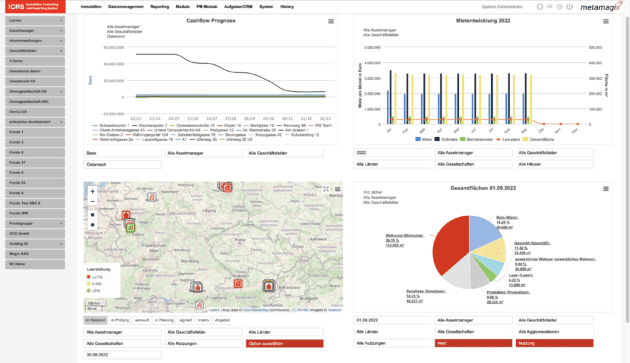

Your Software for Real Estate Liquidity Management

With the push of a button, you can simulate your future cash flow in different scenarios!

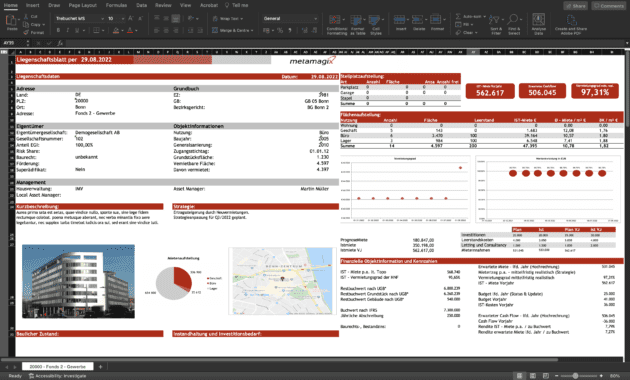

| Area: | 5.700 m2 |

| Market Value: | 13,3 Mio € |

| Occupancy rate: | 97% |

| Yield (VW): | 9.2% |

| Area: | 3.200 m2 |

| Market Value: | 8,3 Mio € |

| Occupancy rate: | 93% |

| Yield (VW): | 5,1% |

Successful Liquidity Management in the Real Estate Industry with ICRS

Increase Your Business Agility

Our solution helps finance managers easily conduct their liquidity management (reporting, analysis, monitoring, planning and controlling) by various tools like DCF simulator, standard and ad-hoc reports, financial dashboards, and planning & controlling module.

Reduce Workload and Be Even More Competent

Imagine how your daily business would look like with such a powerful tool. Reduce your financial risks and make informed decisions when acquiring and disposing of a property or other financial asset.

-

metamagix.ICRS Core System

The out-of-the-box software solution with all the necessary features for successful asset and portfolio…

Info -

DCF Simulation & NPV Calculation

Basis for state-of-the-art cash flow forecasts, property valuation and financial management.…

Info -

Planning & Controlling

Provides a complete planning environment for importing and evaluating plan data and accounting.…

Info -

Scoring & Rating

Evaluate objects with a free definition of scoring models.…

Info -

Transaction Management

With the Sales and Purchase Pipeline modules, you control and document transaction processes directly…

Info -

Market Data

Integrates market data into the ICRS database and allows linking to them in individual…

Info -

Portfolio Explorer

State-of-the-art ad-hoc reporting for all data, directly in the browser of your ICRS system.…

Info -

Development Management

Provides all the necessary features for project monitoring from an owner's perspective.…

Info