When valuing a property for investment purposes, it is important to assess a number of key figures. For small real estate companies, indicators such as net rental yield, cash flow or the ratio of price to income or rent may be sufficient. Larger companies, on the other hand, require a more thorough analysis of their liquidity. Modern solutions have made the risk analysis of potential real estate investment easier than ever.

A scenario analysis takes into account various macroeconomic developments, such as inflation and cost scenarios. It then allows for assumptions about how purchase and rental prices will develop.

A general cost development includes the construction of a building or renovations due to the inflation rates, where companies naturally have no room for manoeuvre. Vacancy periods after the end of rental contracts are also essential for the cash flow calculation. When do my contracts end? How long will the rental units be vacant? What level of new letting is realistic?

In the commercial sector, there are usually regulations on abatement periods, graduated leases and incentives for renting. An appropriate cash flow model maps all these factors and automatically warns of deviations and an impending income gap.

What are good tools for analysing cash flow?

Of course, a cash flow calculation also works on an Excel basis, albeit usually only to a limited extent. The classic spreadsheet calculation is certainly suitable for the rough calculation of an individual investment. For example, the question of how worthwhile it is to renovate a house or which of two projects is economically more lucrative. However, Excel reaches its limits when it comes to liquidity planning across a larger portfolio. Automated industry-level tools are then required.

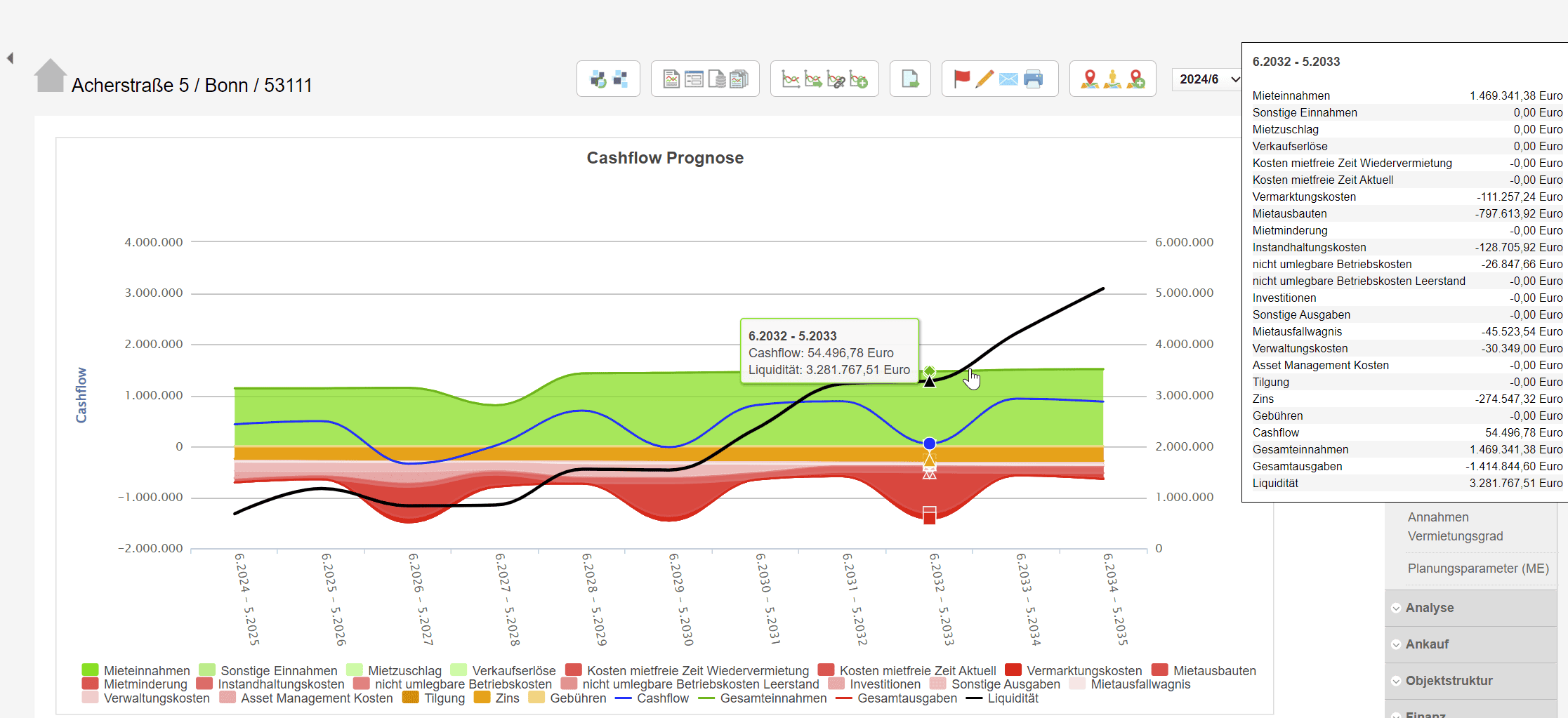

The cash flow module of ICRS, for instance, calculates the cash flows for subsequent years in the ‘best’, ‘base’ and ‘worst’ case scenarios for each property based on rental contract data and various assumptions.

With a scoring and rating module, additional macroeconomic data such as the unemployment rate, economic development in a region and population development can be incorporated into the prognoses. The latter is particularly interesting for “Location Scouting” but is also a topic for risk assessment. Data on economic and population development comes from Eurostat, for example. The Austrian web map service HORA also provides data on the risk probability of flooding, hail or earthquake, which can be incorporated.