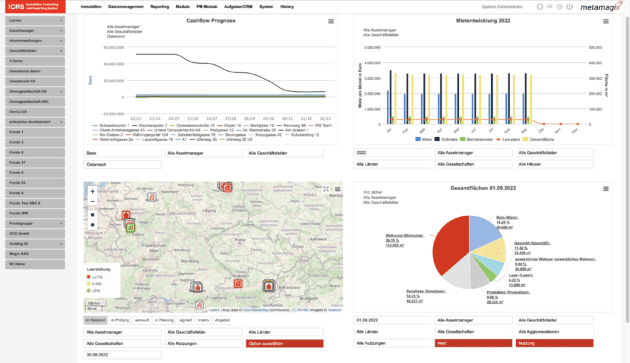

Family Office Portfolio Management Software for Fund Managers

With metamagix.ICRS – you can forecast your cashflow position and make more data-driven investment decisions.

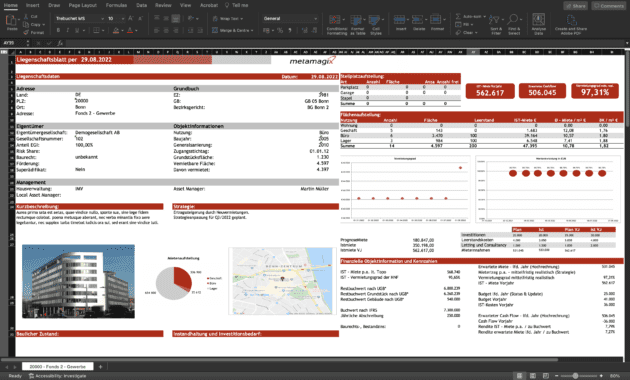

| Area: | 5.700 m2 |

| Market Value: | 13,3 Mio € |

| Occupancy rate: | 97% |

| Yield (VW): | 9.2% |

| Area: | 3.200 m2 |

| Market Value: | 8,3 Mio € |

| Occupancy rate: | 93% |

| Yield (VW): | 5,1% |

Successful Real Estate Assets & Portfolio Management with ICRS

Get an Overview of Your Real Estate Portfolio

Discover key insights into your real estate portfolio for informed decision-making and strategic planning.

Reports for the Property Owner

Reporting to your stakeholders has never been easier. With ICRS, you can automate the regular reports and keep your clients updated.

Transaction Process Management

Streamline your pipeline integration and structuring of acquisition and sales processes within the centralized platform.

Increase Your Business Agility

Our solution helps fund managers easily conduct their liquidity management (reporting, analysis, monitoring, planning and controlling) by various tools like DCF simulator, standard and ad-hoc reports, financial dashboards, and planning & controlling module.

Reduce the Workload

Imagine how your daily business would look like with such a powerful tool. Reduce your financial risks and make informed decisions when acquiring and disposing of an asset or property.

-

metamagix.ICRS Core System

The out-of-the-box software solution with all the necessary features for successful asset and portfolio…

Info -

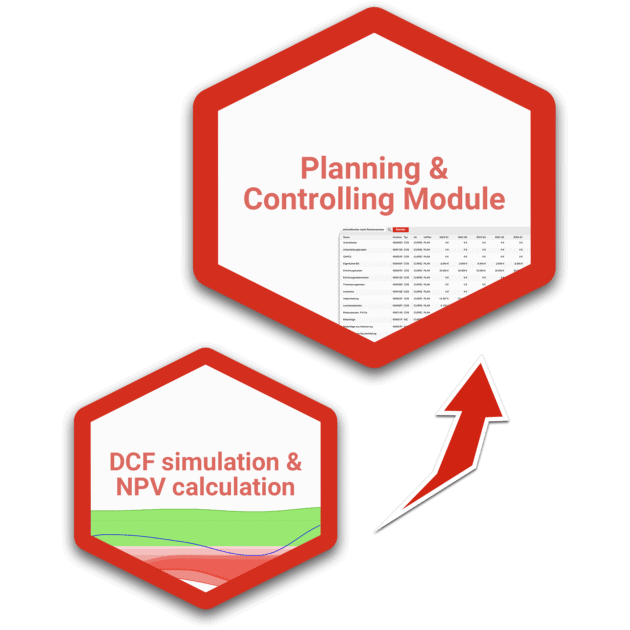

DCF Simulation & NPV Calculation

Basis for state-of-the-art cash flow forecasts, property valuation and financial management.…

Info -

Planning & Controlling

Provides a complete planning environment for importing and evaluating plan data and accounting.…

Info -

Transaction Management

With the Sales and Purchase Pipeline modules, you control and document transaction processes directly…

Info

Plan Your Solution Today!

Don’t struggle alone – make progress faster with assistance