DCF Simulation & NPV Calculation

Basis for state-of-the-art cash flow forecasts, property valuation and financial management.

Basis for state-of-the-art cash flow forecasts, property valuation and financial management.

Eases decision-making for asset and executive management

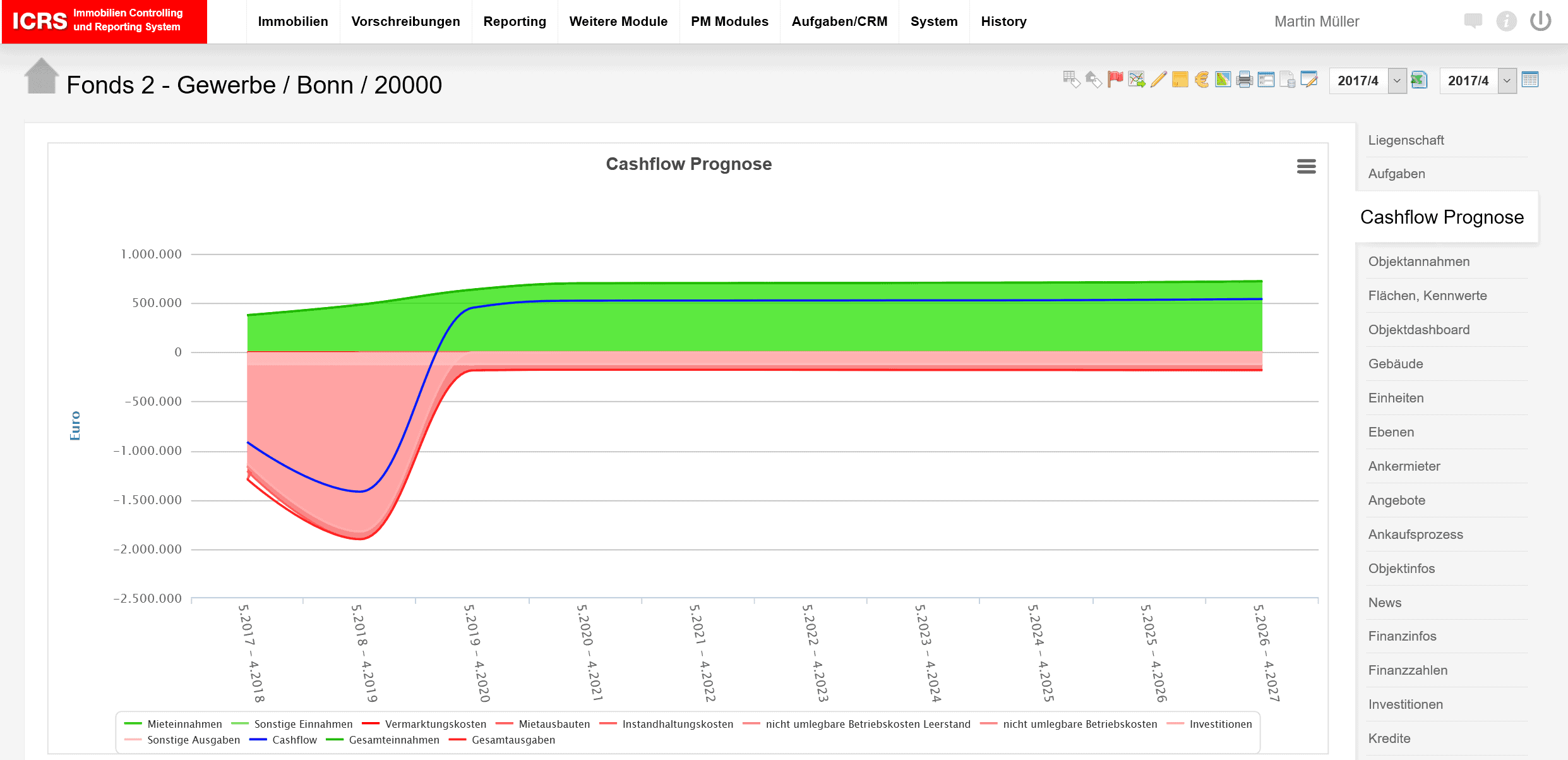

- Cash flow simulation and NPV calculation for existing properties and project pipeline

- Granular control of all scenario parameters down to the individual units directly in the interface

- Extensive analysis options including evaluation of the effects on companies and portfolios

Reporting, planning, controlling

Reporting and creating individual reports is done as usual in Excel or via the user interface. The module calculates three variants (best case, base case, worst case). These are used in combination with the real estate cash flows from the DCF module for comprehensive cash flow forecasts, property valuation and the management of financing.

Additional features

- Forecast future rental cash flows based on current and future occupancy situations and contract data available in the system

- Calculations are performed individually per unit or per individual conditions, integrating recorded capital expenditures and owner costs

- Replaces the time-consuming recording of planning data or estimated values

- Occupancy rate assumptions facilitate planning of projects and apartment portfolios

- Integration with CAPEX planning and leasing processes

- Many scenario parameters can also be managed directly in Excel, ensuring maximum flexibility of analyses

- Fast simulation model setup thanks to the import of forecast assumptions

- Automatic calculation of three cases for multiple market scenarios

- Model copies allow fast “what if?” evaluations

- If requested, this module also calculates loan cash flows based on loan types (repayment, annuity, final maturity), interest rate variants (ACT/360, ACT/365, 30/360) and other loan parameters. Rollover calculations after loan expiration are also possible, based on various scenario parameters such as markups, credit rating, yield curve and more.

How about automated object planning? If this is something you need, combine this module with the Planning & Controlling Module