Scoring & Rating

Evaluate objects with a free definition of scoring models.

Evaluate objects with a free definition of scoring models.

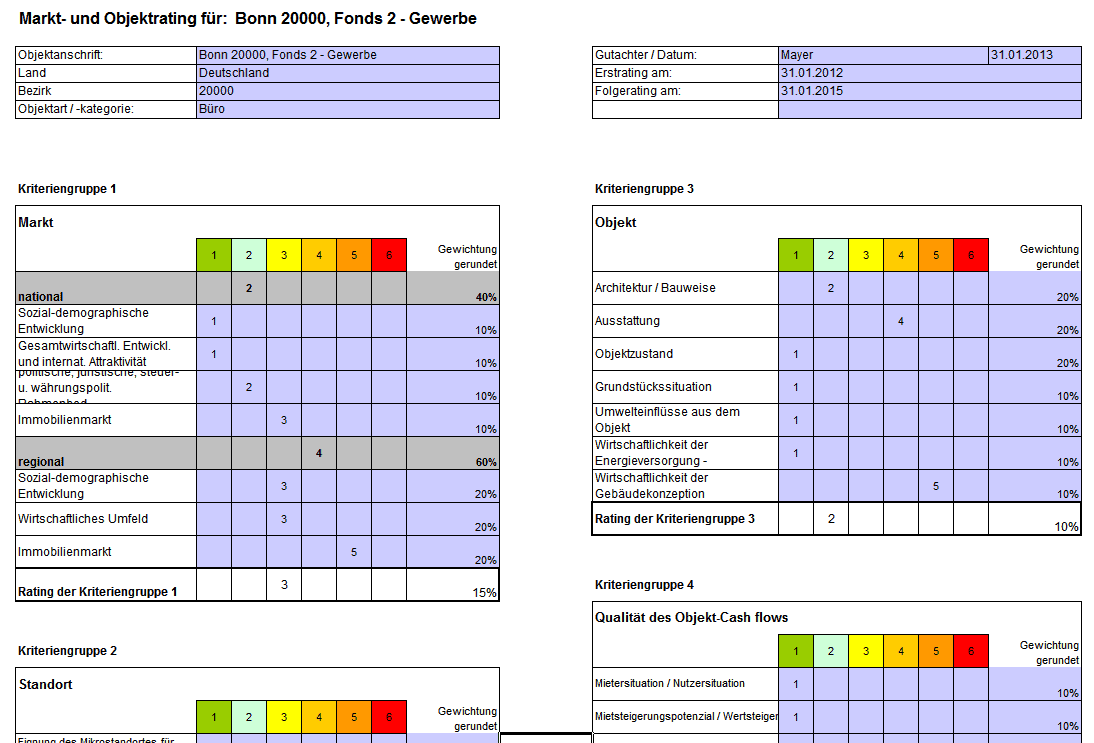

Free definition of scoring models

- Based on criteria and groups of criteria

- Variable weightings for different asset classes to evaluate the real estate portfolio

Management

- Recording of scores via the interface and via Excel import

- Scorings can be stored historically and their development can be analyzed

Reporting

Scorings can be freely combined with all other key figures. Finished scoring reports in Excel can be edited without access to ICRS, for example in the course of assessments or appraisals, and later imported back into ICRS. In doing so, the new ratings contained in the report are automatically stored in the system as a new rating.

Rating options

- Based on TeGoVa-Standard (www.tegova.org)

- According to individual criteria groups based on the business model

For an automatic evaluation of your ratings, combine this module with the Market Data Module.