Real Estate Management Software for Fund Managers

With metamagix.ICRS – you can forecast your cashflow position and make more data-driven investment decisions.

| Area: | 5.700 m2 |

| Market Value: | 13,3 Mio € |

| Occupancy rate: | 97% |

| Yield (VW): | 9.2% |

| Area: | 3.200 m2 |

| Market Value: | 8,3 Mio € |

| Occupancy rate: | 93% |

| Yield (VW): | 5,1% |

End-to-end Management with the Best Data Consolidation

Unlock the Possibilities for Sustainable Success by

Simplifying Work Processes

- Automated merging of data streams from all property management partners of all countries

- Assistance for acquisitions, budgeting, investment planning, etc.

Setting up Detailed Reports

- Operative reporting in assured quality

- Reporting to committees and authorities

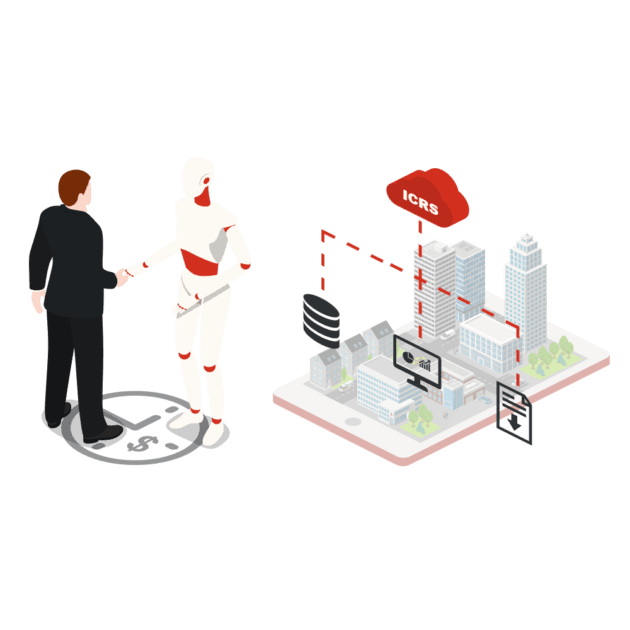

ICRS (Real Estate Controlling & Reporting System)

ICRS is a real estate management software that provides asset and portfolio managers with various modules designed to keep operational expenses and time to a minimum.

The real estate management system includes a core system, real estate planning and controlling module, discounted cashflow simulator, NPV calculator, construction costs tracker, sales forecast on current and planned processes, portfolio tracker, AIFMD risk management, property management solution and many more.

With 20 years of know-how in the field, we are reasonably confident about our out-of-the-box real estate solutions.

ICRS as Fund Management System

Let ICRS do the maths and make your insightful analysis!

ICRS can provide you with the consolidation of all your data streams and available market data and display the overview of imported data on a dashboard. The system enables you to export ad-hoc reports with the push of a button, thereby saving your time and costs for data-driven investment decisions.

Time is a critical resource in fund management. If you don’t automate daily repetitive tasks, you will have to amortise other resources for the time wasted. – To be competitive in the market, you should pay special attention to daily operating activities such as planning, organising data, reporting and decision-making.

ICRS: Fields of Application

- Corporate Real Estate Management

- Stock-listed Real Estate Companies

- Insurance Companies

- Funds

- REITs

-

metamagix.ICRS Core System

The out-of-the-box software solution with all the necessary features for successful asset and portfolio…

Info -

DCF Simulation & NPV Calculation

Basis for state-of-the-art cash flow forecasts, property valuation and financial management.…

Info -

Planning & Controlling

Provides a complete planning environment for importing and evaluating plan data and accounting.…

Info -

Transaction Management

With the Sales and Purchase Pipeline modules, you control and document transaction processes directly…

Info -

ICRS.mobile

Your pocket-sized real estate portfolio with photo upload and task management.…

Info -

Market Data

Integrates market data into the ICRS database and allows linking to them in individual…

Info -

Portfolio Explorer

State-of-the-art ad-hoc reporting for all data, directly in the browser of your ICRS system.…

Info -

Portfolio Matrix and Strategy Derivation

The chief strategist among the modules evaluates your portfolios graphically with a matrix display.…

Info

Plan your solution today!

Don’t abandon existing know-how but data chaos